We have lived through some difficult times, but have been able to draw lessons from this situation. During the last year the Company carried out intensive work to set up communication channels with employee representatives. Mechanisms were developed and implemented, to obtain feedback from KMG EP employees, so that any topical question could be raised and resolved in the shortest possible time. A system has been developed for raising the motivation of personnel. At the same time training sessions were held on how to resolve labour disputes and events were organised aimed at strengthening the corporate spirit. Our task for 2012 was to recover the trust and loyalty of employees and their representatives and to provide the Company with a “strong rear guard” in its production activities.

Today we are witnessing positive changes in our relationships with personnel and believe that the right decisions have been taken. We hope that they will help in closing the ranks of the many thousands of employees of KMG EP and will provide a fresh impulse to the development of a constructive dialogue and mutual respect. We are not working alone in this area. The Ministry of Oil and Gas of the Republic of Kazakhstan, the fund Samruk-Kazyna, our parent company KazMunaiGas and local executive bodies are all providing us with helpful support.

In 2012 substantial changes were introduced to the management structure and business processes of the Company. The production units OMG and EMG were transformed into joint stock companies 100% owned by KMG EP. This provides for the appropriate reporting structures and the improved responsiveness of management at the production level while enhancing the transparency of enterprises. Apart from that, two new service companies were formed, which will not only be offering services to KMG EP and other oil producing companies, but should also help to dampen social tensions in the region.

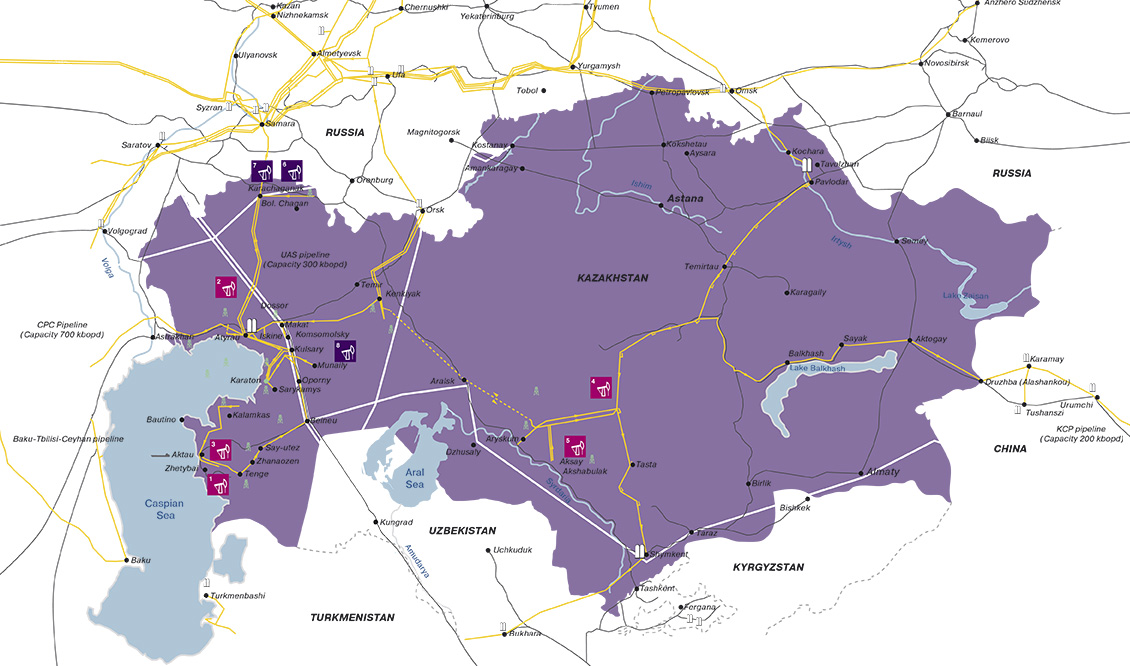

The operational results of KMG EP for 2012 confirm that production at the main assets was stabilised last year. Including the Company’s stakes in LLP JV Kazgermunai, CCEL and PetroKazakhstan Inc., in 2012 the Company produced 12,191 thousand tonnes of oil (247 kbopd), which is only 1% less than in 2011. After the lengthy strike at the end of 2011, KMG EP still needs time to restore previous volumes of production. The infrastructure at several sites is worn out and not all equipment is up to modern standards. This is why we launched an extensive modernisation programme last year which, on completion, should allow us to stabilize production processes at OMG and to make them more resilient in the face of all negative external factors. At OMG we shall have a workshop which is unique in the CIS area for the diagnostics and repair of underground equipment. We shall also have an oil storage terminal, two zones for the preparation of fluids for capping wells; a workshop for servicing oil production equipment; a workshop for repairing oil production equipment and an automotive repair centre with capacity to service 1,000 vehicles and specialised equipment. In addition to this, repairs will be carried out to the water injection system and connected pumping station and systems for the collection and transportation of liquids. Introduction of these new installations will allow us to greatly enhance the effectiveness of production. The programme will be implemented over the medium term with capex estimated at about 100 billion tenge. During 2013 implementation of this programme, and generally solving problems with our production assets will receive the maximum amount of attention, resources and energy.

Despite the fact that OMG is operating in an already established field, it has considerable development potential of its own. During 2012 wide scale research into the potential of the Uzen field was carried out. Based on the resulting reports, independent experts concluded that the field has a considerable future. however, research also showed that for production to be viable, it is necessary to review the production process. Consequently, in 2012 work was initiated on the implementation of modern methods of increasing oil production and new equipment was purchased so that the bulk of future production work will be automated.

In 2012 a horizontal well was drilled for the first time at the Uzen field, where the average daily output was 22 tonnes per day. Based on the positive results and taking into account the existing infrastructure, we intend to continue horizontal drilling in 2013.

KMG EP is at the start of a medium-term programme of geological exploratory works. We adhere to the principle that investments into geological exploration must be economically justified. For this reason the Company has undertaken a strict selection of targets, based on prospective returns on investments and intends to continue future exploration and additional exploration on a case-by-case pragmatic basis.

The strategy of KMG EP is now under review considering the revised strategy of NC KazMunaiGas. We are consistently building up the resources to strengthen the position of one of the leading oil and gas companies in Kazakhstan. Our key objectives are to increase the consolidated volume of production, to replenish and increase reserves of hydrocarbons through the acquisition of new assets, as well as through geological exploration and the optimisation of production at the core KMG EP fields.

As before, we intend to support the improvement of social conditions in areas where we operate, to support training and the professional advancement of the younger generation of oil professionals and to resolve issues of ecology and safety of production.

Our company has already established itself as a conscientious user of mineral resources, a profitable enterprise and a responsible partner for our shareholders. The goal set for KMG EP today is to live up to this reputation and to continue working towards further harmonic growth.

A.NURSEITOV

CHIEF EXECUTIVE